Contents:

We https://1investing.in/ the amortization of intangible assets in the financial statements of a company as an expense. The advantage of accelerated amortization for tax purposes lies in the deferment of taxes rather than in their reduction. A financial problem may result later from the absence of any deduction in the normal income taxes for depreciation. Income-tax expenses can be equalized, however, by treating taxes not paid in the early years as a deferred tax liability.

Regardless of whether you are referring to the amortization of a loan or of an intangible asset, it refers to the periodic lowering of the book value over a set period of time. Having a great accountant or loan officer with a solid understanding of the specific needs of the company or individual he or she works for makes the process of amortization a simple one. Fixed/tangible assets are purchased and used, they decrease in value over time.

Amortization Meaning: Definition and Examples

In addition, since your massachusetts state income tax should ideally remain constant each month, more of it will go toward the principal each month, thereby reducing the amount you borrowed. The debit balances in some of the intangible asset accounts will be amortized to expense over the estimated life of the intangible asset. Depending on the asset and materiality, the credit side of the amortization entry may go directly to to the intangible asset account. On the other hand, depreciation entries always post to accumulated depreciation, a contra account that reduces the carrying value of capital assets. Of the different options mentioned above, a company often has the option of accelerating depreciation.

- So, if the forklift’s useful life is deemed to be ten years, it would depreciate $3,000 in value every year.

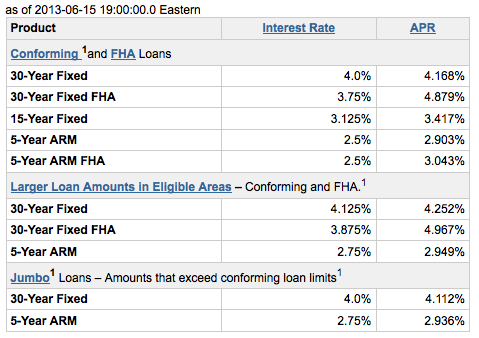

- Annual Percentage Rate is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage.

- The credit balance in the liability account Premium on Bonds Payable will be amortized over the life of the bonds by debiting Premium on Bonds Payable and crediting Interest Expense.

- Amortization in accounting also sets guidelines to handle intangible assets effectively.

- Amortization is important for managing intangible items and loan principals.

- The credit balance in the contra asset account Discount on Notes Receivable will be amortized by debiting Discount on Notes Receivable and crediting Interest Income.

Therefore, it must be depreciated or amortized in the books of accounts to recognize its true value. Companies use methods like depreciation or amortization to depreciate the asset over its useful life. Amortization also refers to the acquisition cost of intangible assets minus their residual value.

What Is an Example of Amortization?

Without this level of consideration, a company may find it more difficult to plan for capital expenditures that may require upfront capital. For example, a business may buy or build an office building, and use it for many years. The original office building may be a bit rundown but it still has value. The cost of the building, minus its resale value, is spread out over the predicted life of the building, with a portion of the cost being expensed in each accounting year. Assets that are expensed using the amortization method typically don’t have any resale or salvage value.

The beginning loan balance is amount of debt owed at the beginning of the period. This amount is either the original amount of the loan or the amount carried over from the prior month (last month’s ending loan balance equals this month’s beginning loan balance). Accountants use amortization to spread out the costs of an asset over the useful lifetime of that asset. Amortization schedules are used by lenders, such as financial institutions, to present a loan repayment schedule based on a specific maturity date. The patent has a useful life of 10 years and an amortization rate of 10%. The carrying value of the patent at the end of Year 1 would be $90,000 ($100,000 less $10,000 of amortization).

Examples of amortization in the following topics:

An amortization plan is used through periodic charges to lower the outstanding balance on loans, such as a mortgage or a vehicle loan. An amortization schedule is a complete schedule of periodic blended loan payments showing the amount of principal and the amount of interest. Amortization can be calculated using most modern financial calculators, spreadsheet software packages , or online amortization calculators.

It is also possible for a company to use an accelerated depreciation method, where the amount of depreciation it takes each year is higher during the earlier years of an asset’s life. Depreciation and Amortization affect the equity and balance sheet of the company, respectively. Due to depreciation, the value of a company’s equity gets affected, mostly reducing.

For example, on a five-year $20,000 auto loan at 6% interest, $286.66 of the first $386.66 monthly payment goes to interest while $100 goes to principal. In the last monthly payment, $384.73 goes to principal and $1.92 goes to interest. Amortization is important for managing intangible items and loan principals. Every year the business records a decrease in the patent’s value, it must also record a corresponding amortization expense equal to the decrease.

Accelerated Amortization Definition – Mortgage – Investopedia

Accelerated Amortization Definition – Mortgage.

Posted: Sun, 26 Mar 2017 05:24:17 GMT [source]

For tax purposes, there are even more specific rules governing the types of expenses that companies can capitalize and amortize as intangible assets, as we’ll discuss. Amortization can demonstrate a decrease in the book value of your assets, which can help to reduce your company’s taxable income. In some cases, failing to include amortization on your balance sheet may constitute fraud, which is why it’s extremely important to stay on top of amortization in accounting.

Due to different durations of holding and other factors, companies use several accounting methodologies, including amortized cost, fair value, and equity. An intangible asset is amortized if the asset has an identifiable useful life. The amortization amount is equal to the difference between the intangible asset cost and the asset residual value. Debt held to maturity is shown on the balance sheet at the amortized acquisition cost. To calculate the period interest rate you divide the annual percentage rate by the number of payments in a year. Many examples of amortization in business relate to intellectual property, such as patents and copyrights.

Not all loans are designed in the same way, and much depends on who is receiving the loan, who is extending the loan, and what the loan is for. However, amortized loans are popular with both lenders and recipients because they are designed to be paid off entirely within a certain amount of time. It ensures that the recipient does not become weighed down with debt and the lender is paid back in a timely way. Patriot’s online accounting software is easy-to-use and made for small business owners and their accountants. In other words, the depreciated amount expensed in each year is a tax deduction for the company until the useful life of the asset has expired. That means that the same amount is expensed in each period over the asset’s useful life.

Amortizing an intangible asset

This is often because intangible assets do not have a salvage, while physical goods (i.e. old cars can be sold for scrap, outdated buildings can still be occupied) may have residual value. For example, a company benefits from the use of a long-term asset over a number of years. Thus, it writes off the expense incrementally over the useful life of that asset. A third disadvantage of amortization is that it can make a company’s financial statements more complex.

- This method is used to demonstrate how a corporation benefits from an asset over time.

- To avoid the missing cost record being perceived as fraud, amortization values must be formally recorded.

- The term amortization can also refer to the completion of that process, as in “the amortization of the tower was expected in 1734”.

So, for example, if a new company purchases a forklift for $30,000 to use in their logging businesses, it will not be worth the same amount five or ten years later. Still, the asset needs to be accounted for on the company’s balance sheet. A loan is amortized by determining the monthly payment due over the term of the loan. The main advantage of amortization is that it allows a company to gradually write off the cost of an intangible asset over its useful life. This is advantageous because it allows a company to spread out the expense over a period of time, rather than having to write off the entire cost of the asset in the year it was acquired.

Amortization, in finance, the systematic repayment of a debt; in accounting, the systematic writing off of some account over a period of years. Determining the capitalized cost of an intangible asset can be the trickiest part of the calculation. An agile finance team will be prepared not just for current expenses but for the future too. With amortization’s help, you will know how much you will incur in the future because of your loans and assets. But these few steps have a rather big impact on your financial value. Amortization is important to calculate the taxable income for a certain period.

When a company acquires assets, those assets usually come at a cost. However, because most assets don’t last forever, their cost needs to be proportionately expensed based on the time period during which they are used. Amortization and depreciation are methods of prorating the cost of business assets over the course of their useful life.