The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you. The results provided by the Planner are generic in nature and do not necessarily reflect the actual investment profile that you may hold and it is not necessary for you to act on it. The Planner provides a generic indication of your money needs to enable you to prioritize your investment needs which are rule based. Therefore, the search results displayed by the Planner cannot be construed to be entirely accurate / comprehensive.

Outstanding Common StockOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased. It is shown as a part of the owner’s equity in the liability side of the company’s balance sheet. Another drawback is that in industries where tangible assets are few, errors may creep into the valuation of its stocks on the book value.

When looking at the financial statements of a business, look for information about stockholders’ equity, also known as owner’s equity. When preferred shares are not present, the entire equity of the stockholders is utilized. In conclusion, whether the company is undervalued, fairly valued, or overvalued will depend on how the company’s ratios compare with the industry average multiples, as well as the fundamentals of the company. In the next part of our exercise, we’ll calculate the P/B ratio using the share price approach, so the corresponding metric is the book value of equity per share .

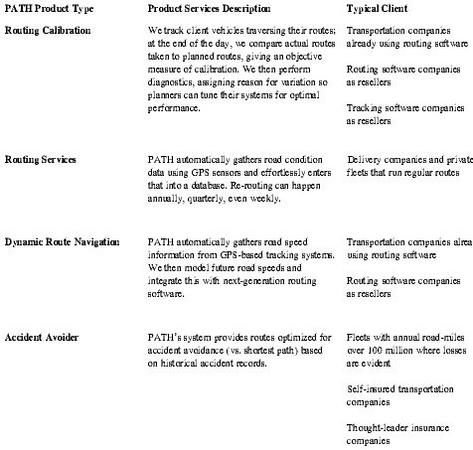

Suresh recently joined as an intern under Vivek and carried a passion for research. Vivek asks him to compute P/BVPS for SBI and then compare peer-to-peer. When deciding to invest in the market, it is important to know the actual share value of a company and compare it with market value and trends. This helps you better create a picture of the investment and how lucrative it will be for you in the long run.

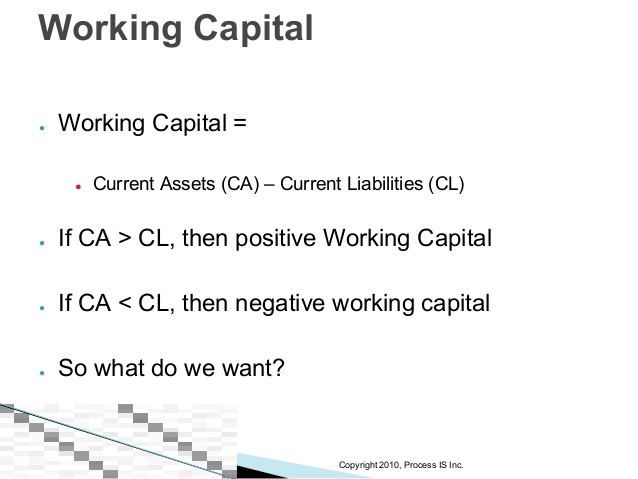

We deduct preferred stock from the shareholders’ equity because preferred shareholders are paid first after the debts are paid off. The book value per share is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. When compared to the current market value per share, the book value per share can provide information on how a company’s stock is valued.

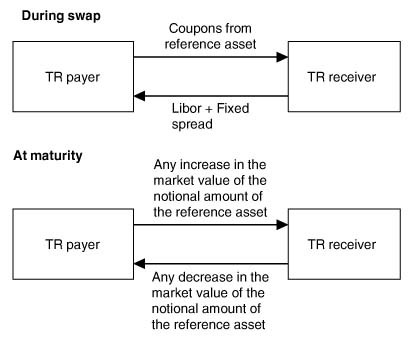

It portrays the relationship between what the market perceives the value of a company’s equity to be and the actual book value of its equity. Secondly, investors need to determine the net value of an organisation’s assets. To do so, they need to add up the book values of all the assets present in a company’s balance sheet and deduct the total value of all debts and liabilities.

What is book value per share?

Assume, for example, that XYZ Manufacturing’s common equity balance is $10 million, and that 1 million shares of common stock are outstanding. This means that the BVPS is ($10 million / 1 million shares), or $10 per share. If a company was interested in increasing its BVPS amount, they have a couple of options. Next, they can look at reducing their liabilities by selling unnecessary assets or using cash flow to pay down debts.

Request you to look at other things as well – revenue, operating margins, PBT, PAT, Debt, Leverage, ROE before making any investment decisions. Hence the EPS gives us a sense of the profits generated on a per-share book per share basis. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. In our last step, we’ll divide the current share price by the BVE per share.

- Clicking “I Agree” to “Terms & Conditions”, shall be considered as your electronic acceptance of this Agreement under Information Technology Act 2000.

- Let us quote an example to understand the workings of book value per share clearly.

- Comparing BVPS to the market price of a stock is known as the market-to-book ratio, or the price-to-book ratio.

- An asset’s book value is equal to its carrying value on the balance sheet, and companies calculate it by netting the asset against its accumulated depreciation.

You can do this through share repurchases, which reduce the number of shares outstanding, or by issuing new shares of stock. To calculate book value per share, simply divide a company’s total equity by the number of shares outstanding. For example, if a company has total equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1. In some cases, the two components are boiled down to a per-share value. In this case, the total value of outstanding shares is divided by the number of outstanding shares of an organisation.

Book value per share considers historical costs, whereas the market value per share is based on the company’s potential profitability. Market value per share is simply the current price of a publicly-traded stock. Book value per share is an important metric that investors use to evaluate the value of stocks.

Guide to Understanding Accounts Receivable Days (A/R Days)

Instead of using the absolute value of shares outstanding, the weighted average shares outstanding takes into account the fluctuations occurring due to new issuances and bulk buyouts over the specified period of time. It gives a more comprehensive, clearer picture of book value per share when used in the formula. Book value per share differs from the market value per share in that it displays the actual share value of a company, instead of the one on stock market indices.

Companies or industries that extensively rely on their human capital will have an inappropriate reflection of their worth in their financial statements. Book value example –The balance sheet of Company Arbitrary as of 31stMarch 2020 is presented in the table below. Booking value, more commonly known as book value, is an organisation’s worth according to its Balance Sheet. In another sense, it can also refer to the book value of an asset that is reached after deducting the accumulated depreciation from its original value. In the below graph, we see the book value of Google for the past ten years. The book value of Google in 2008 was $44.90 per share and had increased by 348% to $201.12 per share by the end of 2016.

The book value per share is a finance tool used to assess the current stock price of a company. Ideally, investors are searching for stocks that have not peaked in their value. While this is usually found on a balance sheet, it is helpful to know how to retrieve this value yourself. The equity is the total number of assets after liabilities are subtracted. The book value per share can be used for calculating the per share value of a company. The calculation is based on the equity available to common shareholders after paying off the debts and preferred shareholders for the which the company is legally obliged.

BVPS Ratio

Book value per share is conceptually comparable to net worth, i.e., assets less debt, and may be seen as an indication of what would happen if operations were to come to an end. The final step of our price to book ratio calculation under the first approach is to divide our company’s market cap by its book value of equity . The Price to Book (P/B Ratio) measures the market capitalization of a company relative to its book value of equity. Widely used among the value investing crowd, the P/B ratio can be used to identify undervalued stocks in the market. Book value is the value of the company’s assets which can be received by the shareholders in the event of company’s liquidation or during bankruptcy.

Any information provided or sourced from ABCL Affiliate belongs to them. ABCL is an independent entity and such information from any ABCL Affiliate are not in any manner intended or to be construed as being endorsed by ABCL or Facilities Provider. The information does not constitute investment or financial advice or advice to buy or sell, or to endorse or solicitation to buy or sell any securities or other financial instrument for any reason whatsoever. Nothing on the Website or information is intended to constitute legal, tax or investment advice, or an opinion regarding the appropriateness of any investment or a solicitation of any type. You are therefore advised to obtain your own applicable legal, accounting, tax or other professional advice or facilities before taking or considering an investment or financial decision. Book Value per share is used to if a company’s share is undervalued or overvalued or fairly valued.

The book value of common equity in the numerator reflects the original proceeds a company receives from issuing common equity, increased by earnings or decreased by losses, and decreased by paid dividends. A company’s stock buybacks decrease the book value and total common share count. Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share.

Book Value Per Share Calculator – Excel Model Template

Do not fall for the value trap by considering manipulated book value for your analysis. Theoretically, a low PB Ratio signifies undervalued stock, but in reality, it may be outdated assets adding to the book value. Hence, if your investment decisions are based on book value, then do not forget to use other financial metrics to find out the actual condition of a company’s assets. Real undervalued stocks are those companies that carry out valuable business operations but have failed to create a shiny image for themselves in this dazzle-dominated world. These companies are the ultimate value plays for intelligent investors. For instance, companies that use wood, gravel, or oil for their core operations tend to face growth with inflation because these products are necessities and their prices also rise with a price rise.

What is Book Value Per Share? Guide With Examples

Preferred equity is money owed to preferred shareholders that have an invested stake in the company and are paid dividends first at a fixed rate. Book Value → The book value on the other hand, is the net difference between the carrying asset value on the balance sheet less the company’s total liabilities. The book value reflects the value of the assets that a company’s shareholders would receive if the company was hypothetically liquidated . In simple words, book value is the sum available for shareholders in case a company gets liquidated.